When customers shop for insurance, they’re looking to work with a company that’s fair, friendly, but most importantly, reliable when they need to make a call. It’s part of the insurance customer experience.

Which makes sense! Insurance is a service that everyone needs, from healthcare, auto, dental, to pet … it seems like every industry has its own form of coverage these days.

Insurance policies are designed to help when an upfront cost is too much to pay, reducing costs for customers while giving them peace of mind that if something unexpected happens, their insurance provider is there to help soften the blow.

But if you’re an insurance provider calling to connect with a policyholder – whether it’s a claim, a rate adjustment, or whatever it may be – and you fail to reach them because your business shows up as an unknown number, you’re missing out on prime connections that can ruin the customer experience.

Looking to improve the insurance customer experience? Here are three key reasons to identify your calls to policyholders.

Insurance Customer Experience: Customers Want a Phone Call

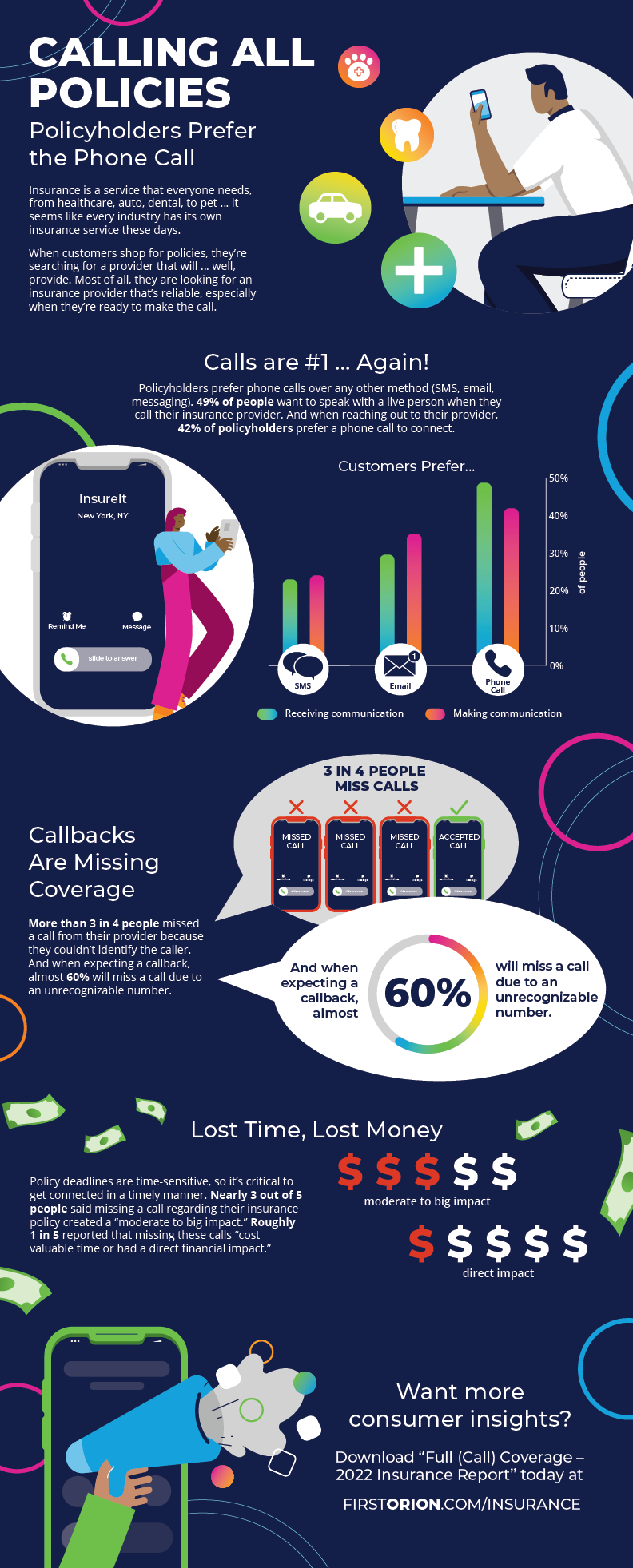

In a survey of more than 5,000 U.S. mobile subscribers, almost half of customers said when they call their insurance provider, they prefer speaking with a live person over the phone rather than through email, text messaging, or messaging apps.

When receiving a call from their insurance provider, the results are very similar. A solid 42% of customers said they want a phone call from their provider if it’s about their insurance policy.

The results are clear: customers WANT to talk to you, and they want to do it with a phone call!

The Real Insurance Fraud? Making an Anonymous Call

Calling from an unknown number? Good luck getting your customers to answer!

When asked about answering calls from unknown numbers, 76% of respondents said they won’t answer a call if they don’t know who’s calling.

How frustrating is that when your call doesn’t get answered and you never get a callback? You and your clients are left wanting more. Missed calls lead to extended games of phone tag, often with neither party reaching the other for the important call.

If you want your customers to answer, ditch the unknown number and identify who’s calling.

Policyholders Take Big Hits When Calls Are Missed

Besides the obvious frustration of missing an important phone call, when policyholders aren’t able to connect with their insurance companies, it can have real consequences for their financial wellbeing.

When asked how a missed call affects customers, nearly 60% said missing a call from their insurance provider had a “moderate to big impact.” Additionally, 20% reported that missing the call “cost valuable time or had a direct financial impact.”

Phone calls that don’t go through not only affect your bottom line; it also negatively impacts the customers you’re attempting to serve.

Looking for more insights into how to improve the customer experience, and how you can ensure your calls are answered? Check out Full (Call) Coverage- Insurance Survey Report and see what opportunities you’re missing when you call from an unknown number.