Top Mortgage Lender Drastically Increases Customer Engagement with INFORM Branded Communication

A top-tier online mortgage lender needed help with answer rates and customer engagement. Branded Communication gave their business the needed boost to increase calls answered and lift revenue.

Product

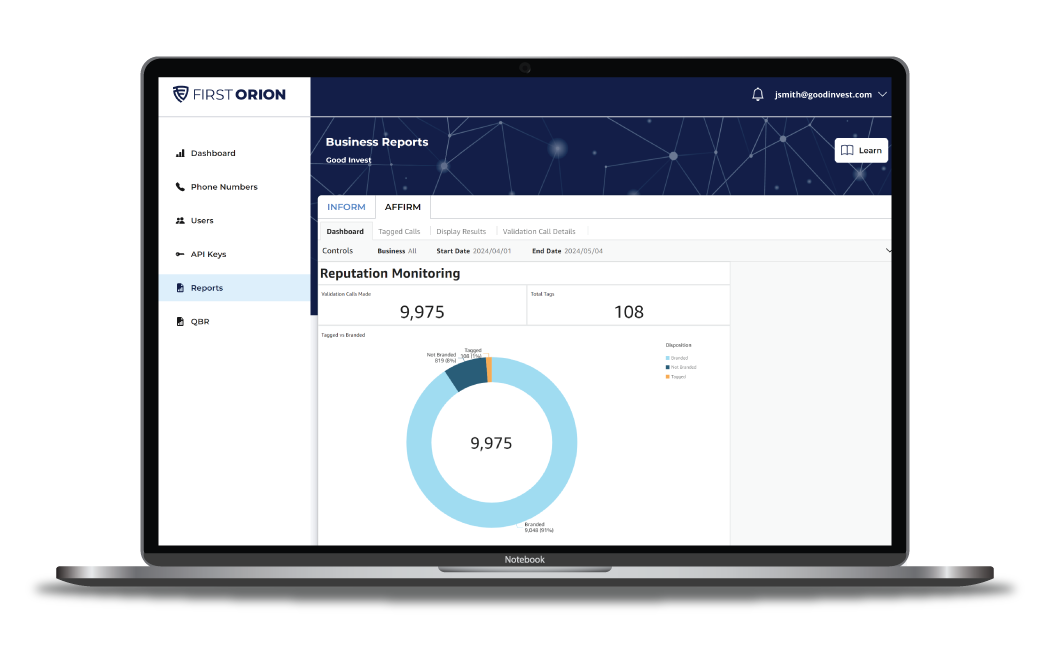

INFORM

Industry

Financial Services

Use Case

Customer Experience

Country

United States

Customers were ready to engage because they knew who was calling

More customers picked up the first time when they recognized the branding

Longer conversations and fewer hang-ups, resulting in quicker resolutions

A top-tier mortgage lender deserves top-tier communication

Originating over 7 million mortgages, one of the top 5 mortgage lenders in the U.S. knows how important trust is to the financial industry. Customers know it’s important too.

According to First Orion’s survey of financial service clients, 90% of people said it’s “extremely” or “very” important that a call from their financial institution is clearly identified.

The mortgage lender struggled to reach potential customers who filled out online loan applications

When customers fill out an online application, lending agents call them to gather more information about the potential clients’ loan needs.

However, even though customers provided consent to be contacted and had expressed interest in the mortgage lender’s offerings, many of their outbound calls went unanswered. Calls were going through, but when customers saw an unknown number on their phones, they assumed the call was a scam and didn’t pick up.

INFORM® identified their calls and increased communication metrics across the board

After implementing INFORM, the mortgage lender saw positive results almost imediately. Customers recognized the business’s branding, leading to a 90% increase in engagement rate, a 26% lift in calls answered, and a 16% decrease in hang-ups from frustrated customers.

Overall, the business saw an efficiency and productivity boost in all of its call center representatives.

Learn How

AFFIRM Can Benefit Your Business