Phone calls are integral to the success of your insurance business. In addition to a strong website and solid social media presence, the key to driving a fantastic customer experience (and improving your insurance marketing efforts) is a good phone call.

The Keys to Customer Experience

Picture this: you’re an auto insurance provider making calls to current and future customers. Your policyholders have questions about their car’s policy – whether it’s an overdue bill, a request for a quote, or the urge to upgrade/downgrade their coverage. But you can’t get through, and now they’ve found a provider that gives a more responsive, more personal customer experience.

So why aren’t they answering the phone? Your outbound call numbers may have problems you don’t know about (aka, an unknown or flagged number). And we all know what unknown numbers will get you: nada, zilch, nothing.

Auto warranty scams have also risen to unprecedented levels, leaving customers afraid to answer an unknown call. Estimates now say that 1 billion scam calls are made to customers – per month!

Survey Says …

This year, we conducted a survey about insurance customer communication preferences and the troubles that come with unidentified numbers.

The survey revealed that a significant portion of people wants a phone call. Nearly half (49%) of policyholders prefer a live conversation when they need to talk to their insurance provider, and 2 in 5 say a phone call is an ideal way to connect.

If businesses want to continue providing value to customers, then strong ethics and good customer experience must be top of mind. The insurance industry specifically finds it challenging to get people to answer and engage in communication, but when your communication efforts are top-notch, it boosts the customer experience.

This is good for providers, right? Unfortunately, just knowing customer preferences isn’t enough. More than 3 in 4 people stated they missed calls because they didn’t know who was calling.

Policyholders are ready to answer your calls, and clearly identifying who’s calling is just one way to improve the insurance customer experience.

Picking the Perfect Auto Insurance Policy

Selecting the right insurance for your policy is a big deal. Choosing a beneficial policy plan takes a lot of thinking, talking, and decision-making.

Policy deadlines are time-sensitive, so it’s critical to connect with policyholders as soon as possible. Nearly 60% of people said missing a call from their provider created a “moderate to big impact.” And roughly 1 in 5 said that missing these calls cost them valuable time and/or affected them financially.

You can’t have that!

What’s one way to improve the policyholder experience and increase call volume and engagement – all while building trust between client and business? Properly identifying your outbound phone calls.

Branded Communication – The Proof is in the Results

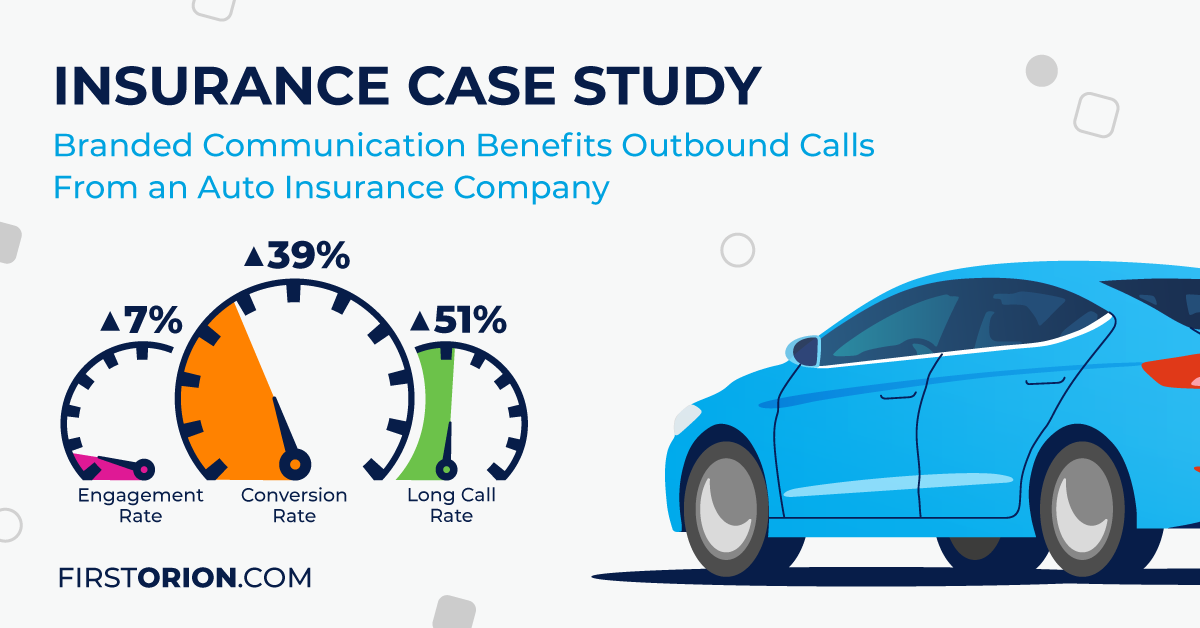

In a recent case study, an auto insurance marketplace attempted to reach out to current clients after they filled out an online form inquiring about an insurance plan. Customers weren’t answering calls, and the auto insurance company was losing potential business as a result.

To solve their little problem, the marketplace invested in our Branded Communication solutions. Rather than leaving the number unknown, the company labeled itself for each outbound call, resulting in these improvements:

- 7% increase in engagement rate – customers who answered were ready to engage.

- 39% rise in conversion rate – more conversions = more revenue!

- 51% lift in long call rate – longer calls mean customers are getting the results they want, and the insurance company is selling more policies.

If you want your customers to answer, kick unknown numbers to the curb and label your calls with Branded Communication.

More sales mean more success. With branded communication, customers can be reached at just the right time. Another client of ours – a direct-to-consumer insurance company – experienced a considerable improvement when using our Branded Text Display solution, INFORM. Have we piqued your interest? Check out our other case studies or discover more insured insights in our Full (Call) Coverage 2022 Insurance Report.