Your financial service provider of choice, such as a bank or a credit union, isn’t just a place to store your hard-earned cash. Yes, that’s a SUPER important function, but those institutions offer so much more, like loans, savings accounts, and small business grants.

People put their livelihoods in the hands of their preferred bank, credit union, or financial advisor. So, it makes sense that when it comes to important money matters, banking clients want to know that those entities have clear communication skills and a solid voice channel strategy.

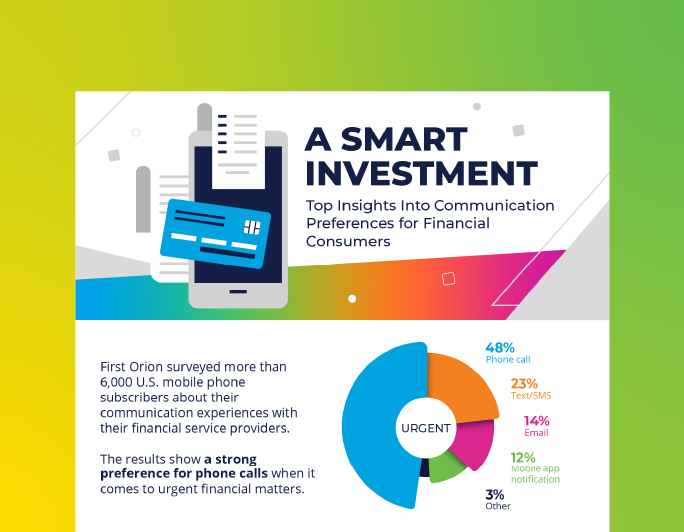

First Orion surveyed over 6,000 U.S. mobile phone subscribers about their communication experiences with their financial service providers. The survey helped identify the impact that branded calling (or lack thereof) had on customers’ perceptions of their financial institutions.

What did we find?

- For urgent matters, consumers want a phone call from their financial institution 2X more than a text message or other notification

- More than half of people said they received a scam/fraud call from someone posing as their bank.

- 90% of people said it’s “extremely” or “very” important that a call from their financial institution is clearly identified with the institution’s name.

General or Urgent? Communication Type Matters

For general matters – those that aren’t urgent – most people are okay with more passive forms of communication such as an email (40%) or mobile app notification (20%).

But if the issue is urgent, 48% of respondents said they prefer a phone call from their financial service provider.

The phone call is preferred more than twice as much as any other option for critical communication.

What a Poser

There’s a good reason that most people are wary of answering a call from an unknown number; scammers and illegal spoofers have cost consumers AND financial institutions a lot of money.

According to data compiled by the Federal Trade Commission, consumer-reported losses increased by more than 70% in 2021 compared to 2020.

And more than half of people said they received a scam/fraud call from a spoofer posing as their bank!

We asked customers to name the leading reasons they prefer a phone call from their bank. Here’s what we found – hint: from our data, it’s clear that suspected fraud is the number one priority for customers when it comes to getting a call from you.

Top 5 Reasons Customers Want a Call from Their Bank

- Suspected fraud

- Financial planning

- Information about a new loan

- Existing money transfer

- Information about an existing loan

Customers Want to Know It’s You

People may not want a phone call in every situation. But there is one thing financial consumers can almost all agree on; when their bank or credit union calls, they want to know who it is on the other line.

We also found that 90% of surveyed respondents said it was “extremely” or “very” important that their financial institution identify itself clearly when calling.

Additionally, if you don’t identify your calls, you’re more likely to lose your customers’ business. More than half, 58%, would choose a different financial institution for one that could properly verify and identify themselves when calling.

Looking for more insights on what your financial customers want from your business? Check out our full report Branding Financial Calls: A Smart Investment – 2022 Financial Services Customer Communications Report.

First Orion is a leading provider of branded communication solutions. Find out more about our INFORM solution, which has helped one of our financial clients see a 90% boost in their call engagement rate.