Today’s post is brought to you by our guest blogger, Wilson the Data Verification Intern. Catch up on Wilson’s last post here.

Today I found out that I’m in big trouble with the IRS. Not because of the $9000 grant from the U.S. Federal Grant Department I told you about last time. That was a cruel scam, dashing my short-lived dreams of how I would spend that money. No, it seems the IRS has a warrant out for my arrest due to miscalculations and improper filing of my 2013-2017 taxes.

You may remember that my job at First Orion is to call phone numbers that have been flagged as potential scammers. Some of the calls are scams, but others are legitimate businesses that have been spoofed by scammers. First Orion is the leader in identifying scam calls because we have real people checking suspected scam calls. Real people listening to recorded messages and asking for a business name. Real people like me.

One of the calls that was on my list was a number with a 202 area code, which just so happens to be Washington DC. That was undoubtedly intentional. I told the man that I had missed a call…which is a lie, I admit… but that’s part of my job. The man asked my name so he could find my file. The name I gave him was not my real name, obviously; I also got creative with my age and occupation. The man identified himself as IRS Officer Frank Miller, which I would bet money that he was lying to me about his name. There we were, both of us using fake names and playing our roles.

Officer Frank Miller informed me that I owed the IRS $3,856. Making the charge a seemingly random – but possibly legitimate – amount is a smart ploy, no doubt to make the scam more realistic. He asked if the miscalculation of my tax payment was intentional or a mistake and I assured him it was an absolute blunder. I did my best to act confused and upset, but not overly so. I also blamed the error on my friend Jason who had been doing my taxes … and yeah, that’s another lie on my part, but by now I had truly immersed myself in the role.

Well, Officer Frank Miller went into quite a practiced monologue, throwing out official-sounding jargon, including something about a violation of Section 720, and reminding me about the warrant that had already been issued for my arrest. If that wasn’t enough, he explained that everything I owned would be seized and I was facing 2-5 years in federal prison. I considered asking if I could request a cell next to my father the embezzler, but decided he would only cut our conversation short. Honestly though, if I hadn’t known it was a scam, it would have been quite upsetting, especially since Officer Frank Miller had really gotten into his character, even sternly telling me, “Do not interrupt” when I had muttered how shocking all this was.

After I played submissive with Officer Frank Miller, he offered me an out. He explained that he could stop the arrest warrant and wouldn’t have to hire a lawyer or appear at the courthouse. Did I want to resolve this outside of court? I meekly told him that I did.

“Do you have the $3856 to make the payment today?” he asked. I sighed and tried to sound desperate but determined. With a shaky sigh, I replied that I could get it from my bank account.

Officer Frank Miller told me to write down his name, his badge number (IRS25060), and my Case ID (CD67792) and then gave me another phone number to call for instruction on how to make my payment. I dutifully wrote everything down and then was scolded one last time and warned that I must take action today. I assured him that I would. But I lied…again…to Scam Officer Frank Miller.

I thought that would be my only exciting call of the day; but just when I thought my afternoon couldn’t get worse, it was Officer Kevin Brooks, Badge Number 70019, Case ID IR6063, who wanted $3500 and a late fee from me due to serious miscalculations on my 2012-2016 tax return, in violation of Section 701! Officer Brooks informed me that the IRS had already sent a letter but had gotten no response. He also asked me if my error was intentional or a mistake, but with an added spin informed me that I was being recorded and for my “words be true.” I said as confidently as I could that it was most definitely a terrible mistake, and resisted the urge to ask Officer Kevin Brooks if he worked in the same scam IRS office with Officer Frank Miller.

Officer Kevin Brooks told me that I was to appear at the courthouse tomorrow at 10 am. He didn’t mention a specific courthouse, but he did warn me that if I didn’t show up, my driver’s license would be canceled and my bank accounts frozen. I resumed the role I had played earlier and acted appropriately worried and submissive, but this time it was with a new name and personal story.

Officer Kevin Brooks seemed to take pity on me quickly and offered me the “out.” He stressed that I was being recorded and I could avoid the courthouse appearance and all the other terrible things, but I had to agree that I would not disclose anything to a third party (oops). He repeated several times that I could not involve or tell anyone! I pretended to be the type of person who would believe that the IRS would make such demands and said that I wanted to avoid legal action, but inside I was laughing because his English was not the best and he repeatedly told me that I had to keep this matter “confidently” instead of saying the matter needed “confidentiality”.

Once scam IRS Officer Kevin Brooks believed he had me, he got demanding. He told me that in order to avoid all the terrible things that I had to take action RIGHT NOW! He explained that I had to keep him on the line and he would guide me step-by-step on making the payment. Of course, I wasn’t going anywhere, so I told him that I was at work and couldn’t leave (the only truthful thing I said to him).

“You have to go now,” Officer Kevin Brooks insisted.

“But I can’t, my boss isn’t here and I can’t leave the store unattended,” I pleaded and asked if I could call him back.

“You have to tell your boss that you must leave.”

I told Scam Officer Brooks that I could probably take a break in 15 minutes and asked again if I could call him back at that time.

“No, I will stay on the line with you to make sure we get the payment.”

He was not letting me off the hook, but I had a new tactic. I told him that my boss was due back any minute and that I couldn’t be caught on the phone. Still no luck. He said that he would wait. He told me to put him on hold.

So I did. He may still be holding.

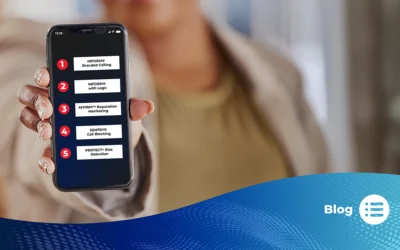

Remember friends, the IRS has posted these tips. To block the bad guys I verify every day, download PrivacyStar for free.