First Orion surveyed more than 5,000 U.S. mobile subscribers about their communication experiences with their financial service providers at the end of 2021.

We conducted a follow-up survey in 2022 where another 1,000 U.S. mobile subscribers were asked questions to further understand communication behavior and the impact of branded calling (or lack thereof).

Where applicable, the following report publishes our findings and makes comparisons to a similar First Orion-conducted survey from 2020. Survey respondents were from 49 of 50 states in the U.S., split equally among men and women, with 2% reporting “other.”

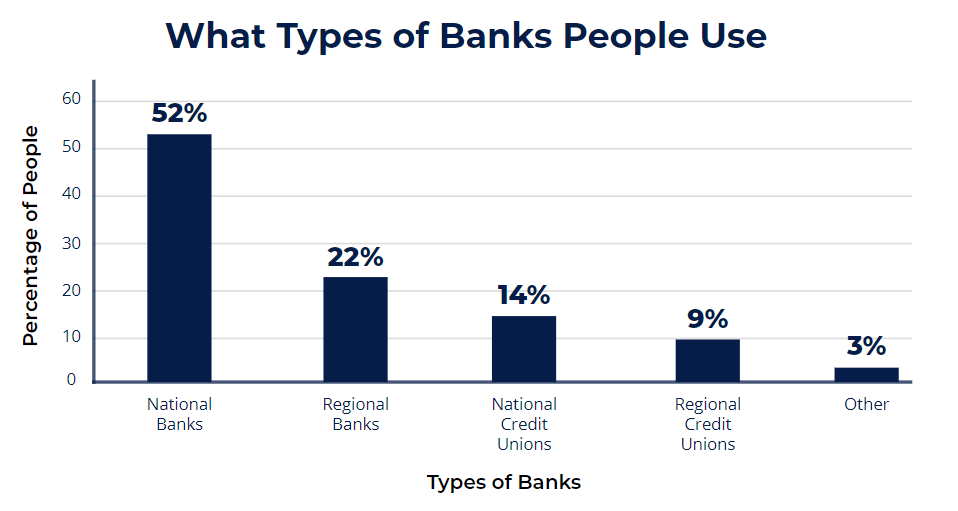

These combined findings represent U.S. customer sentiment as it relates to national and regional banks as well as national and regional credit unions.

The findings illustrate the calling practices of those institutions as well as the consumer preference for calls and messaging as it relates to their personal finances.

Key Findings

For urgent matters, consumers want a phone call from their financial institution 2 times more than a text message or other notification.

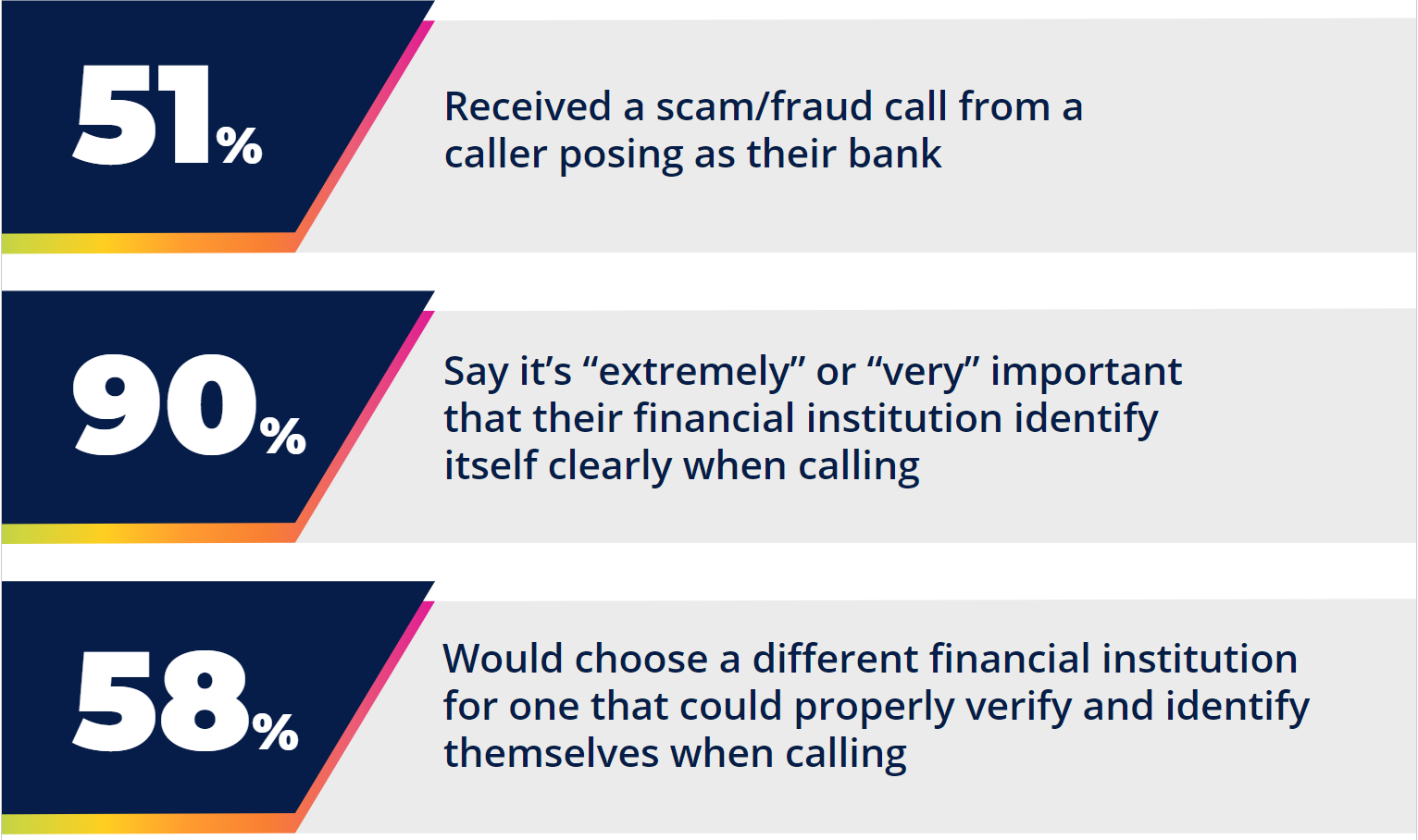

Over half of people said they received a scam/fraud call from someone posing as their bank.

90% of people said it’s “extremely” or “very” important that a call from their financial institution is clearly identified with the institution’s name.

Communication Currency – What’s the Rate of Interest?

People talk to their banks for a variety of reasons. Opening a new account, completing a loan application, inquiring about a transaction, seeking help for stolen/lost cards… the list goes on.

People also have a range of communication options at their fingertips – mobile apps, online banking, text messaging, and phone calls – but their preferences are dependent on the situation.

For general matters, like promotions or account statements, people say that email is perfectly acceptable. In fact, they prefer email (40%) over every other method of communication.

For urgent matters, however, things change dramatically.

The preference for phone calls more than doubles compared to routine communication types (48% – Urgent vs. 19% – General). The phone call is also preferred over twice as much as any other option for critical communication.

Survey Says…

We asked people why they prefer the phone call over other communication methods.

People like the efficiency and security of a call and the ability to elaborate and ask questions.

“I find phone calls to be most efficient in complex matters.”

“A phone call gives me the opportunity to explain myself better and to ask follow-up questions.”

“I believe phone calls are a more secure method of communication, especially when it comes to banking issues.”

Calls for Urgency…

A phone call for urgent matters makes perfect sense. A phone call is personal and has a sense of immediacy.

The number one reason people want a phone call from their bank or financial institution is for suspected fraud. More than half (54%) said they want a phone call for issues, such as suspected fraud. This is a 14-point increase over 2020, when 40% of people said they wanted a call for that same reason.

Investing in Trust

People are leery of unidentified numbers, and with good reason! Scam and illegal spoof calls can cost customers and financial institutions a LOT OF MONEY.

In 2021, consumer-reported losses increased more than 70% over the previous year, according to data published by the Federal Trade Commission.

When 9 in 10 people say it’s “extremely” or “very important” that their financial institution identify itself clearly when calling, it’s easy to see why.

And if you aren’t branding your calls? Nearly 6 in 10 people would choose a competing financial institution that does.

Calls for Other Money Matters

Do people want a phone call for other matters unrelated to fraud? Of course.

Share of wallet is pivotal for financial service providers and nearly one-third of consumers prefer a phone call to discuss matters such as financial planning, new or existing loans and money transfers.

Top 5 Reasons People Want a Phone Call From Their Bank

1 – Suspected fraud

2 – Financial planning

3 – Existing money transfer

4 – Information about a new loan

5 – Information about an existing loan

Time is Money – In Their Words

These survey responses reflect the customer experience with missing a call from the bank:

“I was not aware of my bank’s number and so I missed a call regarding a fraud follow-up. I then had a difficult time getting in touch with the caller.”

“I was contacted by a number from my bank and ignored it. It turns out my card was put on hold because it suspected fraud because I ordered something online and it was charged in another state. I was unable to use my card for gas because I did not answer the call to verify.”

“One time my bank called me about a credit card issue, but I did not recognize the number and it went to voicemail. When I played back the message, I realized it was an important matter from the bank. I called them back the next day but had to wait a long time on the line to talk to someone. I also was a day late on my payments. If I had picked up the phone when they called the previous day, this would have been resolved much more quickly and without incurring a fee for a missed payment.”

Cashing In – A Case Study in Better Banking Experience

A First Orion survey revealed that for industries that deal with sensitive information – like banks, credit unions, and financial services customers ranked the phone as their top preference for communication.

However, nearly 2 in 3 (63%) said they missed a call from their bank because they didn’t recognize the number or who was calling.

One top national mortgage lender addressed their unknown number issue with First Orion’s Branded Communication suite. When following up on digital loan applications, the client reported a 51% increase in long-call duration rates, which led to more completed applications compared to connecting with a non-branded call. Also seeing:

- 26% increase in answer rates

- 90% boost in engagement rates

Deliver Confidence In Every Call

Ready to get started with Branded Communication? Get started today!