Connecting with financial customers is difficult, and today’s global pandemic makes it even more challenging. In this financial services industry report, we explore how financial institutions are using Branded Communication to successfully connect at higher rates using the phone call.

To better understand how consumers are interacting with their banks – more specifically, how they’re interacting with customer service and the pain points that come along with it – First Orion commissioned a blind research study of more than 2,000 financial services customers in North America.

This report was first published in 2020. For the latest results, check out our 2022 Financial Services Industry Report.

Armed with these results, we explore:

- New marketing technologies that boost higher connection rates with your customers and prospects.

- How companies are deploying these technologies at minimal cost for acquisition, retention, and reactivation.

- New consumer insights on how financial services customers want to engage with your business.

Key Points

- 66% of customers have missed calls from their banks or financial services firms because of unknown numbers

- 70% said they’d leave their current bank for one that could properly ID their calls

- Businesses have seen as high as 220% lift in answer rate by alerting customers that it’s them who is calling

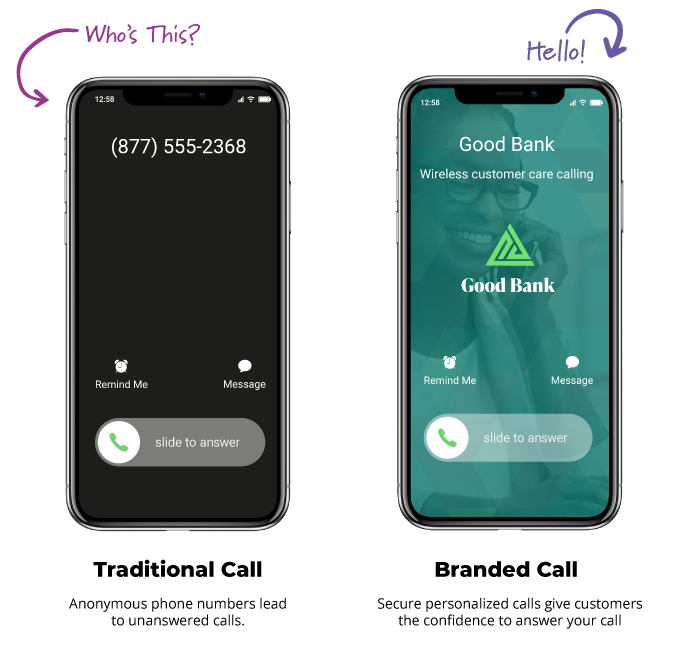

Customers Don’t Know It’s You

Your customers want to take your call but, according to the research, 66% of customers have missed calls from their banks or financial services firms. This is mostly because they didn’t recognize the incoming number on their phone screens.

Even when expecting a call, consumers still don’t trust their phones. The constant inundation of spam and scam calls has trained us to screen and ignore calls.

The vast majority of our survey respondents (92% actually) said it was extremely or very important that a call from their bank is clearly identified so they know to pick up.

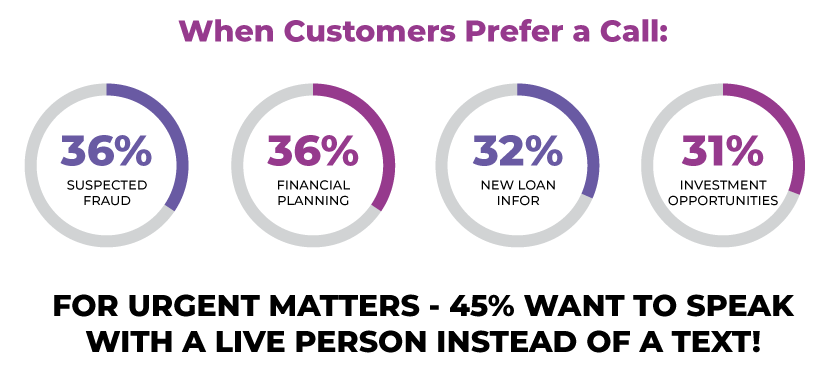

Customers Want Your Phone Calls

Financial institutions do more than safeguard money.

Banks, credit unions, and financial service providers must regularly communicate sensitive information to protect their customers’ financial well-being.

With the growing consumer demand for digital technologies, it takes more than mobile banking to form a trusted relationship. Even with SMS, chatbots, money transfer apps, and social channels, your customers want a phone call for financial matters.

Securing the phone call is the next logical step.

For an industry that deals with sensitive information, this correlation becomes significantly clearer. The phone ranked 34% as the most secure method of communication, three times higher than SMS.

The Risk to the Financial Services Industry

We asked consumers – if all other things were the same between their current bank and another bank that offered clearly labeled calls, would you consider switching?

70% of respondents said yes.

Consumers also indicated that phone calls felt the most secure out of all forms of communication – eclipsing text and messaging by nearly three times.

Marketing Tech Breakthrough: Branded Communication

Transparency and security are critically important to customers in the banking and financial service industries. Delivering a secure personalized phone call overcomes the challenges of unanswered calls. It also achieves measurable financial and customer satisfaction benefits.

Results Beyond Answer Rates

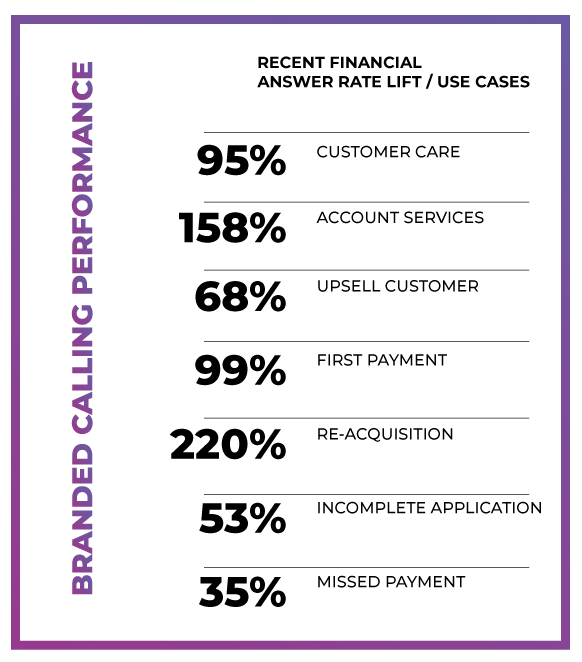

Those in the financial industry who use Branded Communication have already experienced success. By alerting customers that it’s them who is calling, businesses are realizing a significant lift in answer rates – as high as 220%!

More importantly, are the results beyond the answer rates. When processing new applications, such as loans or new accounts, completion rates on applications increased by 30% for one customer simply because they connected with a branded call.

And as for customer retention, Branded Communication has been successfully used to follow up on missed payments. It has also increased answer rates up to 35%, with successful payments rising to up to 20%.

Branded Communication Solutions

ENGAGE® is First Orion’s Branded Graphic Display solution.

ENGAGE enables businesses to present a content-rich branded message on the customer’s mobile device every time they call. It provides instant recognition with your name, logo, and reason for calling.

Build Brand Awareness Through the Phone Call

Branded Communication opens an untapped branding opportunity for companies. Think about how often your employees place calls to customers. With Branded Communication, each phone call serves as a branded ad for your company, with little cost and effort.

Marketing and advertising departments spend a bundle promoting their identities across numerous channels. Now, with Branded Communication, companies are adding phone calls to their marketing mix to maintain visibility with customers and reinforce their brands.

Branded Communication has increased first-call answer rates across use cases. The following are metrics from companies using First Orion’s Branded Communication Solutions.

First Orion: The Pioneer in Branded Communication

First Orion is a leader in telecommunications. We have more than 12 years of experience servicing enterprises, carriers, OEMs, and SMBs. As the pioneer in the call enhancement movement, our Branded Communication Solutions are in place across the globe.

Customers using First Orion’s Branded Communication Solutions report a range of benefits:

- Increased call answer rates and resolution

- Customer engagement on first attempt

- Increased revenue

- Personalized customer experiences

- Valuable outbound call metrics

- A safer, trusted calling experience for customers

Get in Touch with Us

To learn how to put Branded Communication to work for your business, contact First Orion today. Our experts are at your service to help you understand the options for best achieving your business objectives.

This report was first published in 2020. Our latest analysis can be found in the 2022 Financial Services Industry Report.