Top Online Insurance Platform Increases Policies Sold With Branded Calls

Assurance, a top-tier online insurance platform, provides multiple policy types, and potential customers can use form-to-call requests to receive more information. By adopting Branded Communication, they increased their engagement rate and sold more policies in the first 30 days than without branded calling.

Product

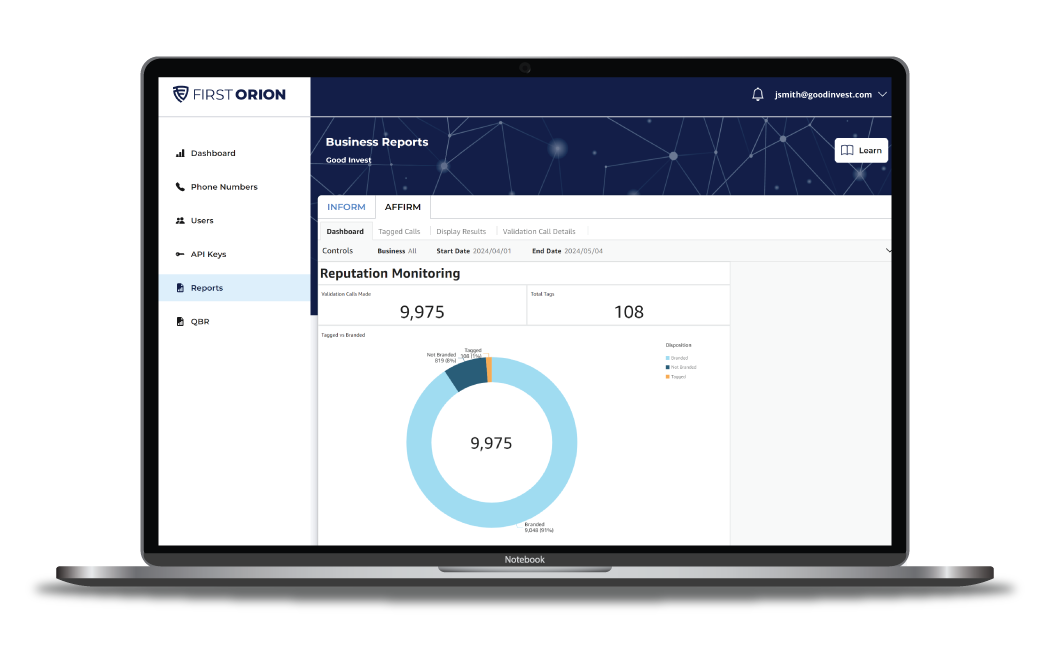

INFORM

Industry

Insurance

Use Case

Increased Revenue

Country

United States

Company

Customers who answered stayed on the phone longer because they were ready to talk

When customers engaged longer, more conversions occurred and revenue grew

In order to scale revenue, online insurance platforms need to sell policies quickly

People need insurance, for everything. Life, health, auto, home – you name it. But if insurance providers can’t quickly sell policies to engaged customers, they waste time and revenue opportunities.

Assurance, a top online insurance platform, needed help getting their policies sold, and branded calling came to the rescue.

Customers requested communication via form-to-call but were not engaging or buying policies

Assurance uses a form-to-call method on its website where customers can request a phone call to receive more information about policies.

However, when agents called customers, prospects would not engaged with the unknown call – meaning Assurance struggled to close deals and sell policies.

With INFORM, the business boosted its long call duration rate and sold more policies in the first 30 days

By implementing INFORM to their outbound calls, customers were able to identify Assurance, and were more likely to engage with its agents.

Branded calling boosted their long call duration rate by 36%, which translated to a 30% increase in policies sold in the first 30 days! Assurance not only created a better customer experience, they also saved time and money with a branded phone call.

Learn How

AFFIRM Can Benefit Your Business