First Orion surveyed more than 2,100 mobile subscribers to see consumer experience with mobile phone scam calls in the first half of 2022.

We also gathered results from our in-house data which detailed consistent scam tactics, call volumes, and hardest hit areas in the U.S.

Even with federal regulations and market-ready solutions for companies to properly identify their outbound calls, scammers are pulling out all the stops to torment people, especially in the last six months.

Key Points:

- 53% of people say they received more scam calls in 2022 than 2021

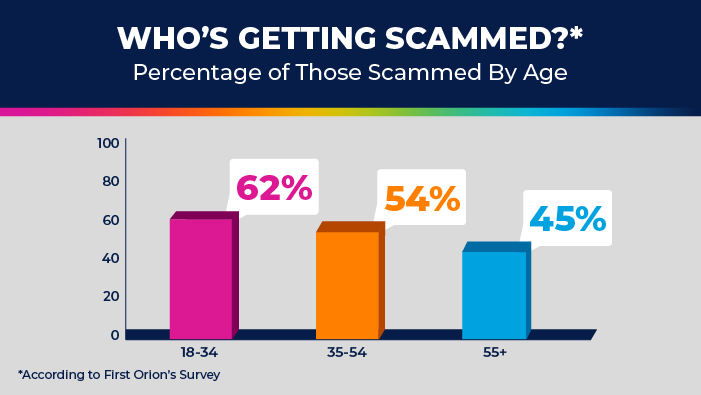

- Two-thirds of 18-34-year-olds reported a financial loss due to a scam call to their mobile phone, while less than half of those over 55 years old reported the same

- 42% reported receiving a financial-related scam call this year

6-Month Impact

Based on measured proprietary scam call data, First Orion estimates U.S. mobile subscribers received over 100 billion scam calls during the first six months of 2022. This projects to over 80 million successful scam attempts resulting in cumulative financial losses as high as $40 billion.

Scammers never seem to take a break from harming unsuspecting victims. According to our survey, more than half (57%) of respondents said they had suffered a financial loss due to scam calls at some point in their lives. Nearly 2 in 5 (39%) reported losing more than $250 to scammers, with some respondents sharing they had lost more than $2,000 to a scam call.

Industry Impact

The top 5 most spoofed entities, according to First Orion data:

- Insurance (Life, Health, Auto)

- Government (Social Security, IRS, etc.)

- Warranty (Vehicle and Home)

- Healthcare (Healthcare and Pharmacy)

- Financial Services (Bank, Credit Union, Financial Advisor)

Our survey responses found that 2 in 5 people have received financial-related scam calls, ranking it as the most reported scam.

Who’s Receiving These Calls?

This year, we’ve seen more scam calls than we can count, and consumers are starting to lose count as well. According to the survey, 53% of people reported receiving more scam calls in 2022 than in 2021.

But who’s really falling for these phone scams?

There’s a stigma around older generations, suggesting they fall for scams more easily. But according to our survey, we found that’s not always the case. In fact, 2 in 3 (62%) of 18-34-year-olds reported having experienced a financial loss due to a scam call, while less than half (45%) of those over 55 years old report the same.

Either way you look at it, it seems that the younger you are, the more likely you are to be scammed.

The Top Scams of the Year

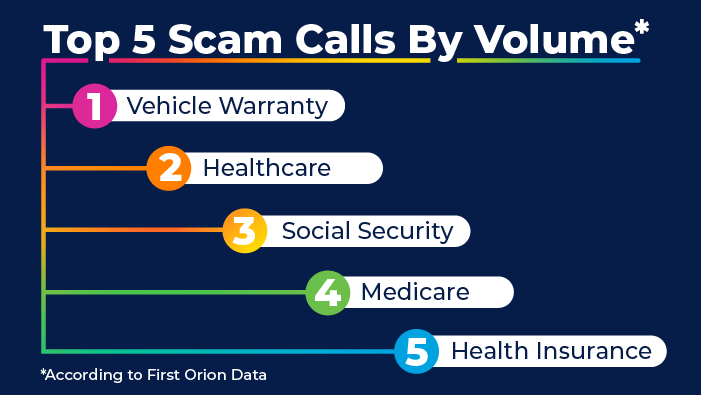

According to First Orion data, the top 5 scam call types by volume are vehicle warranty, health insurance, social security, Medicare, and healthcare.

Unsurprisingly, our report’s top scam type for almost every month this year was the vehicle warranty scam.

Top 5 Scams: Vehicle Warranty

Vehicle Warranty scams try to sound legitimate by using language like “expired coverage,” “vehicle service contract,” and “final courtesy call.”

Calls are often spoofed to look like numbers in the same area or state where the person lives, which is a tactic called neighborhood spoofing. Other calls use toll-free numbers as spoofing tactic.

Here’s what one survey respondent said they experienced with a scammer:

Top 5 Scams: Healthcare

Healthcare scams often target seniors, uninsured consumers, parents, or consumers with chronic issues like diabetes.

The scammer often identifies themselves as a representative from Consumer Council, Senior Aide, Senior Aide Helper, or United Advisors.

They often leave messages that offer healthcare benefits and discount quotes on insurance, hearing aids, etc.

Another surveyor had this encounter with a healthcare scammer:

Top 5 Scams: Social Security

There are two primary types of Social Security scams: Fraudulent activity and the promotion of eligible benefits.

When scammers claim there is “suspicious” activity on a person’s account, they’re more likely to react quickly to protect their personal information. The sense of urgency is what scammers bank on with this tactic.

Scams claiming social security eligibility are similar to any other benefit-offering scam tactic. A “once in a lifetime offer,” or “press one to get this amazing opportunity” are common phrases used by scammers.

Top 5 Scams: Medicare

Medicare scam calls often ask for a person’s Medicare number and other associated information. These scams are often easy to believe, particularly when they know the age or other personal information of the person they are calling.

Another tactic that scam callers are using is neighborhood spoofing. They rapidly rotate numbers and include toll-free call-back numbers in their scams.

A survey respondent said that a scammer attempted to sell them Medicare when they didn’t need it:

Top 5 Scams: Health Insurance

The health insurance scams overlap with the Medicare scams and use a lot of the same techniques and messaging to fraud consumers.

Open enrollment periods are often peak times for these types of scams, but we see healthcare-related scam activity all year. Scams tactics include offers to fix an enrollment, a claim issue, a special offer, or a gift for signing up.

Targeted Scams: Locations Hit Hardest

So, we know who is affected by these scammers, but where are these scams happening most often?

Phone scams are everywhere, but there are certain spots scammers like to pester, time and time again. If you’re in Michigan, Ohio, Oklahoma, or Texas, we found that you may be at risk of receiving more scam calls than in other states.

Top Cities Hit by Scammers:

- San Antonio, TX

- Dallas, TX

- Fort Worth, TX

- Cleveland, OH

- Tulsa, OK

- Lubbock, TX

- Tyler, TX

- Detroit, MI

- Lawton, OK

- Oklahoma City, OK

Scam Trends on the Rise

It’s not only the common scam tactics making names for themselves. Scams waiting in the wings or behind a dark alley have been waiting for the right moment to strike on a potential victim.

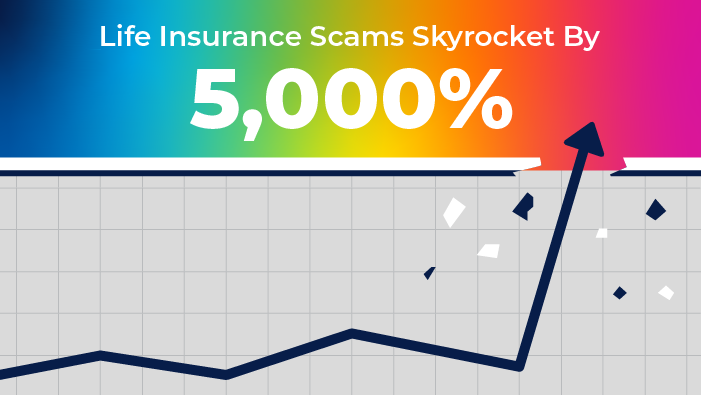

Life Insurance

In the last 90 days, our data shows that life insurance scams have surged by more than 5,000%. Yikes! If there’s anyone you shouldn’t trust with life insurance, it’s a scammer on the other line.

The tactic with this scam uses phrases like “approval at the state level” for a discounted senior plan and promises 100% coverage for funeral costs.

Finance

Everyone worries about their finances. These types of scams tend to target those requesting financial assistance.

Home Warranty

Another scam targeting seniors; home warranty calls provide a callback number, which sets up a swift capture of one’s personal information.

Other Scams to Avoid

As time goes on, technology steadily improves and people adapt. Scammers are also adding new ways to sucker someone out of their money. Here are more scams to avoid:

- Utility Impersonation

- Cryptocurrency

- U.S. Customs and Border

How to Protect Yourself

So, you know all the latest and (not so) greatest scam trends. Now, how do you protect yourself for the future?

Most businesses can take the first step in protecting their brand and consumers by registering their business numbers with their phone service providers.

Kent Welch, our Chief Data Officer, recounts tips to protect yourself from scammers:

- Don’t answer unknown numbers. If it’s important, they’ll leave a message.

- This one may seem obvious, but don’t give out any personal information like your social security number or your birthday over the phone. And definitely don’t go along with a plan to send them payment.

- If you hear a robotic voice asking you if you’d like to be placed on the “do not call list,” don’t fall for it. Don’t press the button, don’t say yes – because that’ll put you on a list of active callers. Hang up.

It’s always best to avoid interacting with a scammer. If you have received any suspicious or scam-like calls, be sure to report your findings to the FTC.