Student loans can follow you for a large part of your adult life – which is why it can be a lucrative target for scammers. If you’ve got student loan debt, you might have seen ads or been contacted by companies who promise help and relief. Some of those are scams – and the FTC is going after them.

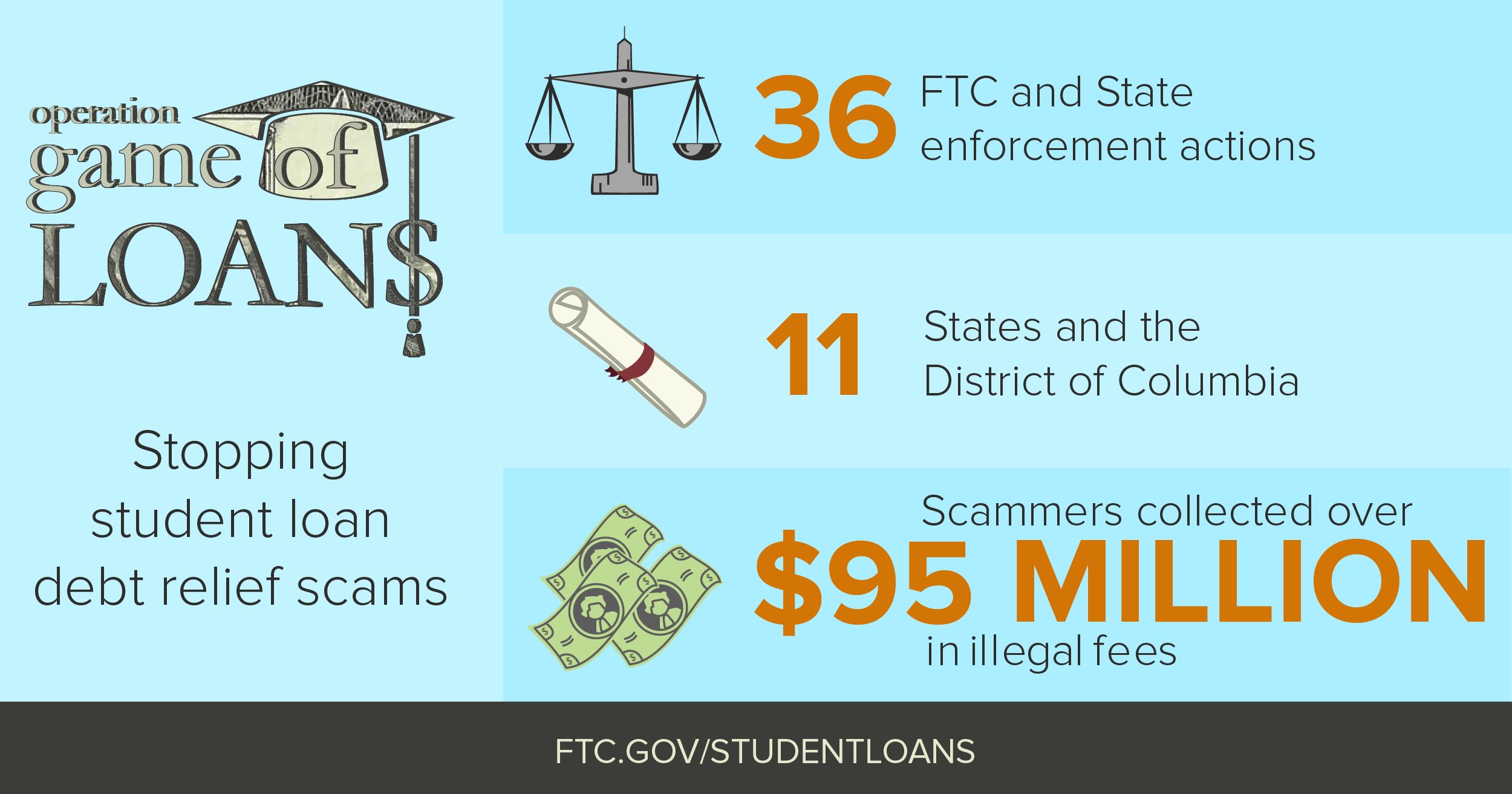

Today, the FTC announced Operation Game of Loans (we love a good pun!), a joint FTC and state law enforcement sweep against student loan debt relief scammers. The operation includes seven actions filed by the FTC, with five new cases announced today.

So here’s how the scams usually work. You’ll get a call from someone claiming to be affiliated with the government or your loan provider promising to reduce or eliminate student loan debt. Sounds pretty appealing, right? They’ll tell people they are “pre-approved” or “pre-qualified” and then pressure them to sign up for the program on the spot. Here’s where they get you: enrolling requires consumers to pay an illegal advance fee of $1,500. After you’ve paid, the company disappears, doing little to nothing about your debt. At minimum, consumers get help for services they could have gotten from their loan servicer or the U.S. Department of Education for free.

If you need help with your student loans, paying isn’t a necessary option. There’s nothing a company can do for you that you cannot do for yourself for free. If you are a federal borrower, StudentAid.gov/repay is a complete guide to repaying your federal student loans. Private borrowers can get options from their loan servicer.

If you get one of these shady calls, here’s how to avoid the scam:

- They ask for an up-front fee. Who pays big bucks before doing their research, just because they’re pre-approved? If you wouldn’t buy a car without driving it, don’t even think about paying for a service you haven’t received yet. It’s illegal for companies to charge you in advance before helping you – if you pay upfront, you’ll likely get no help OR refund.

- They promise “Fast Loan Forgiveness.” They don’t even know your situation! Scammers might say they can quickly get rid of your loans through a forgiveness plan…but, spoiler alert: they can’t.

- That “Department of Education” seal doesn’t mean it’s legit. Thanks to Google, scammers can find plenty of official-looking names and logos to rip off. They can say they have special access to certain federal programs all they want, but it doesn’t make it true.

- Don’t share your FSA ID with anyone. Remember when we said they don’t know your situation? Scammers could use that to get into your account and take control of sensitive information. When in doubt, just hang up.

For more resources on student loans from the FTC, check out their new Student Loans page.